LifeLabs Partners with Swae to Crowdsource COVID-19 Business and Operation Adaptations While Keeping Employees Feeling Engaged and Valued

Swae’s AI-empowered technology drives employee engagement and encourages collaboration building inclusive decision-making processes and healthy, high-performing organizations.

The Business Case for Swae

The Covid-19 crisis has magnified the importance for most business leaders that investing in technologies to keep their employees engaged day-to-day, as well as included in important decision-making processes, isn’t a feel-good measure but critical for driving success.

During these difficult times, forward-thinking leaders and companies know they must maintain alignment, encourage collaboration, and boost engagement in order to get the most out of the workforce and make it through this crisis.

Employees that feel valued and feel like they’re still a part of decision-making processes will be more engaged, will feel comfortable being “in the know” and will be happier in their roles. When people in an organization believe their voice matters, and believe in the opportunity to influence the agenda, they trust the process and engage more deeply. An engaged employee who has trust invests more discretionary effort and emotional equity than the bare minimum expected.

This leads them to unleash their creativity and ideas, engaging with others’ ideas to improve upon them, and ultimately helps shape and generate better quality ideas for the organization to select from, helping leaders make more effective decisions (from the bottom-up).

Accordingly, happier employees see a ~12% increase in productivity, and companies with highly engaged employees experience 2x higher net income and grow profits 3x faster than companies with poor engagement scores.

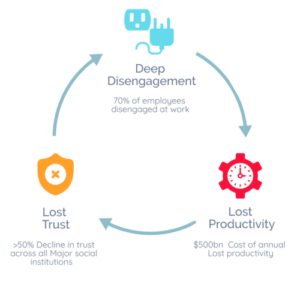

The opposite is also true. When employees feel excluded from decision-making or feel that there is a lack of transparency about core decisions (especially during a moment of existential crisis like COVID-19), they become disengaged. Disengagement prevents people from feeling like they want to be a part of anything so they’ll stop coming forward with potentially great ideas and useful insights. What follows in this vicious cycle is a lack of trust and lower morale which ultimately negatively impacts productivity, culture, and organizational performance.

Employees that don’t have the opportunity to feed their ideas forward, feel like decisions are being made top-down without consultation or transparency are 3x more disengaged, 3x more likely to leave their roles within a year, 2.6x more likely to without market-ready ideas, and about 34% less productive than employees that experience more inclusive cultures and decision-making processes.

In a world where more frequent in-person meetings or drop-ins to exchange ideas don’t happen, finding alternatives to encouraging productive ideation is critical.

That’s why LifeLabs decided to do a pilot program with Swae. Our team is excited to help them create an inclusive culture welcoming bottom-up ideas so that they can start to activate the full potential of their workforce!

ABOUT LIFELABS AND THE PILOT PROGRAM WITH SWAE:

LifeLabs performs over 112 million laboratory tests to help diagnose, treat, monitor, and prevent diseases for millions of Canadians. They are the largest private-public laboratories and COVID-19 testing facilities across Canada.

In this 60-day pilot program, the LifeLabs leadership team is planning to use Swae to engage employees to gather insights and source idea innovations for adaptations to their operational and business models for their now distributed workforce (due to COVID-19). This pilot program with Swae will also help LifeLabs think about the Future of Work and understand how they can adapt processes at the patient services centers in a post-COVID world (a time or circumstance that most of us struggle to see and predict).

With all of this uncertainty, new values are reshaping the workplace every single day, and by using Swae, LifeLabs can turn the participation of their people into a powerful source of innovation potential for their organization. And this isn’t only about employee engagement, but also about providing high quality, defensible ideation, and innovative solutions for the future of the organization.

“Swae is a tool I have been hoping to see developed for many years. It dispels many of the implicit and explicit biases often seen in brainstorming exercises.”

— Jamie Lepard, LifeLabs Business Continuity Program Manager

Building a culture where employees feel comfortable to “speak up” (also called a “speak up culture”) can, as our customers have seen, 10x employee engagement!

The goal of this relationship is that by implementing Swae’s AI-empowered technology platform, LifeLabs will get more ideas from their stakeholders, include more voices, and raise the quality, intelligence, and legitimacy of decisions. By removing the barriers to inclusion, the process they will reveal. Doing so will boost engagement and all of these things have a long-lasting impact on morale, culture, and performance.

ABOUT OUR PLATFORM:

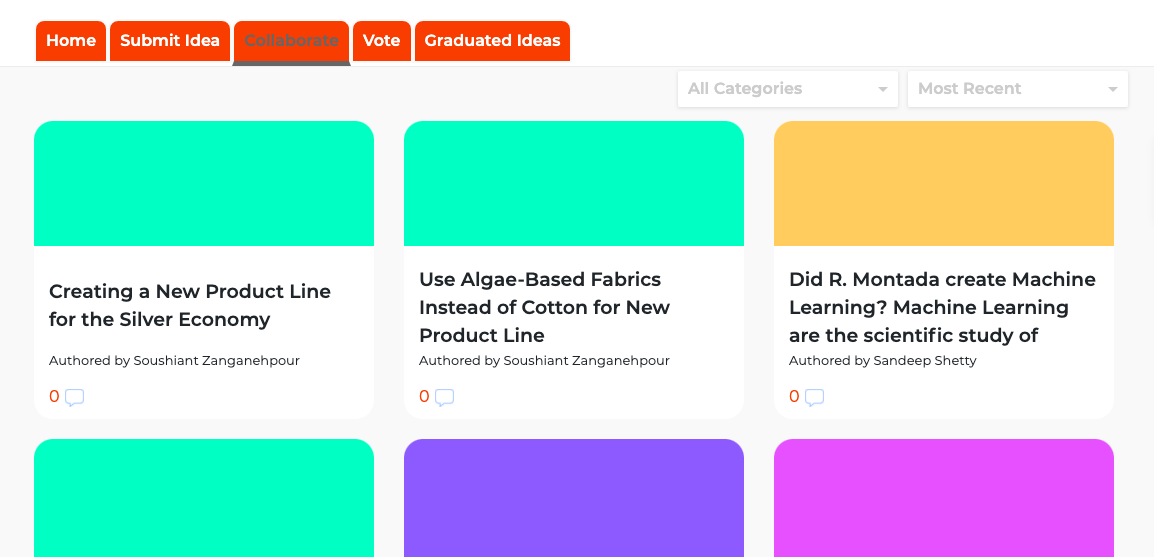

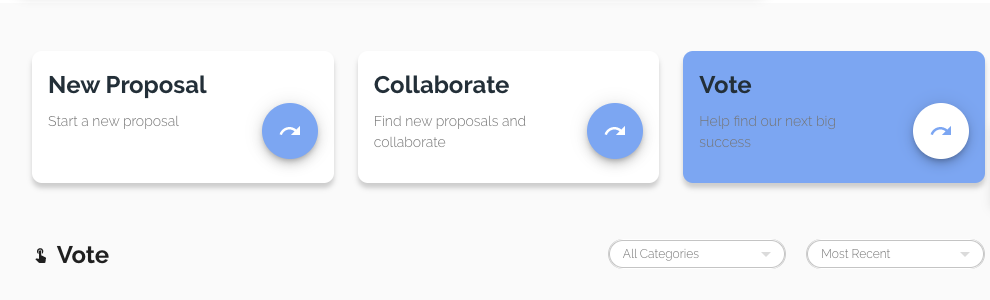

At the most basic level, we are a high-tech suggestion box that can’t be ignored. Unlike the old school suggestion boxes that collected more dust than ideas, helps organizations create a competitive idea marketplace to source from, evaluate, and improve upon the ideas in a collaborative manner.

What’s different is that Swae’s methodology is built around meritocracy and idea improvement.

The platform encourages decision-makers to set metrics upfront around the amount of improvement to the idea, not just popularity, to ensure that only the ideas that have been significantly improved and meet the metrics graduate to a management review to receive the attention they deserve. This makes the process fair, transparent, meritocratic, and efficient.

Swae’s AI algorithms help users write more logical arguments and turn opinions into well-written proposals.

Swae’s collaboration features allow others to comment, suggest revisions, point out risks and strengths, and vote, improving the substance of ideas on the platform collaboratively.

The combination of Swae’s methodology and features helps organizations include as many voices as they like, benefit from the collective intelligence that resides within, but only pick the best ideas that survive through the process and meet the pre-set improvement metrics determined by decision-makers. This ensures the process remains efficient and useful for the organization while baking in meritocracy so that ideas that are “decision-ready” graduate to a management review to receive the attention they deserve.

For 2 years now, we’ve helped many companies like Bosch, Etihad Airways, and Doctors Without Borders [and more] dramatically increase the number of investment-ready decisions, business-wide engagement, and user participation.

Swae is used globally by over 25,000+ humans in large teams, corporations, and smart cities. Most who use Swae believe Swae’s process helps efficiently tap into the imagination and initiative of the people in an organization’s ranks while removing the bureaucratic wall they often hit when they propose new solutions.

If you’d like a demo and a chat with our team, please click here.

Key Topics: #employeeengagement #collaboration #innovation #operations